Finding the balance: What’s driving the price of oil?

A bullish beginning

After a bullish first quarter of the year, it’s clear the crude oil market has turned bearish in the last few weeks. What’s less clear is why. If you asked 100 oil traders, you may get some wildly different answers, but we’ll try to offer our own outlook in this edition of ‘The Commodity Perspective’.

The bulls have broadly controlled the oil price from early December last year to the beginning of April. WTI and Brent were amongst the first commodities to show strength in the most recent rallies across commodities markets.

The geopolitical backdrop of conflicts in the Middle East and Ukraine, OPEC+ staying firm on its production cuts until at least June, and generally more optimism about global demand all helped tighten oil markets—Brent crude peaked at over $90 a barrel, up more than 25% from December.

Of course, whenever there’s a commodities price rally, momentum-chasing speculators aren’t too far behind, pushing prices up even further.

As with most price action in commodities markets, the fundamentals and the financials are almost impossible to separate. In this case, it looks like the fundamentals came in slightly weaker than expected, but the market reacted to the downside overshoot of Q4 2023, and funds were willing to look past short-term weakness, given that they are still expecting tight supply and demand balances in Q3 2024.

“Whenever there’s a commodities price rally, momentum-chasing speculators aren’t too far behind, pushing prices up even further.”

Oil price volatility

Then, around April 12, the market turned.

Crude’s geopolitical risk premium decreased as traders judged that the risk of conflict escalating in the Middle East was diminishing. The macro outlook and demand appeared much more uncertain after March’s CPI print and the prospect of ‘higher for longer’ interest rates.

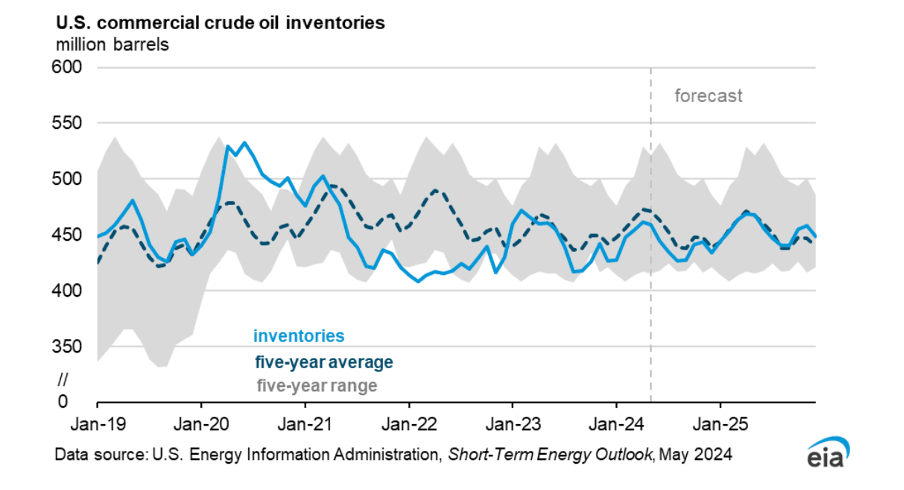

The price volatility was compounded through April by the inevitable profit-taking by those money managers. We then saw further price drops at the start of May, following a surprise 7.3M-barrel build in U.S. crude inventories, which put the demand story back on the front page.

At the time of writing (May 15), crude oil prices are in the low-$80 range; digesting the latest CPI inflation numbers and awaiting inventory data from the U.S. Energy Information Administration (EIA) later today. We’re also entering a critical period for oil markets in May and June. The strong summer demand for the U.S. driving season traditionally begins on Memorial Day weekend, May 29, and that aligns with the OPEC+ ministers’ meeting to review output allocations on June 1 in Vienna. The next couple of months will set the tone for the oil market for the rest of the year, and important questions will need to be answered:

- Are these lower prices justified, and is crude finding fair value in a more balanced market around this current level?

- Is there too much bearish sentiment about a lack of demand vs supply as we look ahead to the rest of the year?

The demand outlook

With the volume of spare capacity on the supply side from the voluntary OPEC+ cuts, global oil demand is currently the most important backdrop for the long-term view of benchmark crude oil prices. What we’ve seen in recent months is a tangible gap between various demand growth forecasts for 2024.

OPEC is most optimistic; its estimate – unchanged in its most recent report, published May 14 – is that world demand in 2024 will grow to 2.25 million barrels per day (bpd). That’s significantly more than the International Energy Agency (IEA), which is forecasting growth of 1.2 million bpd, and the even more pessimistic EIA, which announced last week that it now expects global oil and liquid fuels consumption to grow by 920k bpd this year, down from its April forecast of 950k bpd.

OPEC points to strong air travel demand, road mobility, and “healthy” industrial construction and agricultural activities in non-OECD countries. Clearly, there’s a political and financial incentive for OPEC to predict higher growth. At 1.2 million bpd, any easing of OPEC+ production cuts looks unlikely. In contrast, at over 2 million, the group can keep their members largely united behind the voluntary cuts policies with the prospect of normalising production later in the year.

One area that the demand forecasts do agree on is that almost all the growth will come from non-OECD countries, most significantly China. The IEA estimates that China continues to lead demand growth even as its share of the global increase decreases from 79% in 2023 to 45% in 2024 and 27% next year. By contrast, according to the IEA, oil consumption growth in the OECD will decline this year and next.

Concerns about the softening of demand have controlled the price narrative in recent weeks, sustained by that unexpected jump in U.S. crude stocks at the start of May. However, that build of 7.3M barrels mostly reversed the unseasonably bullish print from the week before (April 24’s numbers saw a surprising draw-down of more than 6.3 million barrels). The fact is that commercial inventory levels in the U.S. are mostly in the middle of their normal seasonal range as refineries – back online after their spring maintenance – ramp up utilisation rates ahead of the U.S. summer driving season.

“Concerns about the softening of demand have controlled the price narrative in recent weeks”

Too bearish?

The market will wait to see what the latest EIA weekly inventory data shows (May 15), but is the pessimism about supply-demand balances too bearish?

Of course, the answer is complex, and we will look at the supply side in greater detail below. However, one crucial factor supporting the bear’s case is the weakness in U.S. transportation fuel demand as we approach the critical summer season. Recent EIA data indicates that gasoline and diesel demand have been at their weakest seasonal levels since the Pandemic, with refining margins also down. However, the latest numbers from the API suggest a decline in gasoline inventory of 1.27m barrels last week (w/e May 10).

Regardless of what’s happening with inventories, if those numbers are indicative of the wider U.S. economy, then the bear case may well be validated as the summer, a season of heightened energy demand, progresses.

All eyes on OPEC+

Investors weighing up oil demand and the macro-outlook have dominated recent price action, but OPEC+ will return to the spotlight in early June. The group’s Energy ministers will meet in Vienna to decide what to do with its voluntary output cuts of 2.2 million bpd beyond June. The market expectation is that an extension of at least some of the cuts is likely, especially considering the recent sell-off. The suggestion is that OPEC+ would prefer a tighter market and higher prices for longer before boosting supply.

The EIA estimates that OPEC’s spare production capacity is ~4 million bpd, which provides significant support in historical terms. Besides the Pandemic, we’ve not seen this much spare capacity since the Financial Crisis, and we’re now in a much different macro environment.

“The oil price is currently defying the wisdom that conflict in the Middle East means higher prices.”

In many ways, it demonstrates that we’re now in a higher price regime for oil. In previous market conditions, it might have seemed improbable for oil prices to reach the $90 mark and to have OPEC keeping back ~4 million barrels of spare capacity, which is an important reminder that whenever the oil market feels tight in this current higher price environment, it’s tight because of the strategic policies from OPEC+, or more specifically Saudi Arabia. If any holders of spare production capacity choose to deploy it, oil can be made available to the market in the event of any short-term supply disruption.

That could be one of the reasons that the market appears reasonably apathetic about the prospect of escalating conflict in the Middle East. The oil price is currently defying the wisdom that conflict in the Middle East means higher prices. Despite a relatively short-lived price spike after Israel retaliated against Iran, oil’s geopolitical risk premium has largely been sold off with talks of ceasefire and the market supporting the probability of a narrower conflict as the most likely scenario.

Beyond OPEC+

Beyond any escalation in the Middle East or Ukrainian forces’ continuing to target Russian refineries, one of the concerns for OPEC+ will be the growth of supply from non-OPEC producers. For context, according to the IEA, the additional production volumes from the U.S., Brazil, Guyana, and Canada could come close to meeting world oil demand growth in 2024 and 2025.

In Canada, after long delays and a cost of C$34 billion ($25 billion), the Trans Mountain pipeline expansion (TMX) started operations on May 1. In their latest ‘Short Term Energy Outlook’, the EIA forecast that the TMX would mean a production increase of 500k bpd in 2024/25, with crude now able to flow from landlocked Alberta to Canada’s Pacific coast.

The U.S. will provide the largest supply growth, adding 650k bpd and 540k bpd, respectively. These numbers are significantly less than the 1 million+ bpd growth from 2023 but will still give OPEC+ policymakers pause for thought.

They’ll be watching for any more uptick in U.S. output growth amidst concerns that OPEC producers will have to fight for market share. This would increase the risk of a disorderly collapse of the production cuts agreement, which has already been fraying around the edges.

What next?

As we look ahead to where oil prices will go for the rest of the year, it’s clear that the market is in a delicate balance. It’s divided over demand forecasts, waiting for greater clarity about supply, and with macro factors such as inflation and geopolitics still threatening.

The recent sell-off represents a healthy correction ahead of a pivotal moment for oil markets in the next two months. Supply-demand dynamics should become more evident in the next few weeks as summer starts in the Northern Hemisphere and OPEC+ makes its next move. Still, these prices are probably closer to the fundamentals after the recent rally boosted by speculators.

So, will the bears or bulls take charge for the rest of the year?

There’s no easy answer, but we’ll hopefully have a clearer direction in the next few weeks. In the meantime, stay safe in the choppy price action to come.